Not quite a full moon. Shot handheld while in my underwear on the front porch.

Margareta Magnusson

Not quite a full moon. Shot handheld while in my underwear on the front porch.

I remember how excited I was when I moved to Portland 10 years ago and found out my apartment was on the parade route. Awesome views right from the comfort of my 2nd floor living room. But Rose Festival or Starlight parade now? Nope. I just don’t like dealing with crowds.

Rumor has it Fujifilm is about to drop an X-E5 with IBIS and a 40 MP sensor.

Of all the footwear I’ve owned through the years, only my Chacos remain. They are indestructible and will outlive me. They are eternal. They are time itself.

“This ‘Weekend at Bernie’s’ remake sucks.”

Also, I updated my blog with a modified version of the Microwave theme on Micro.blog. I’m digging it.

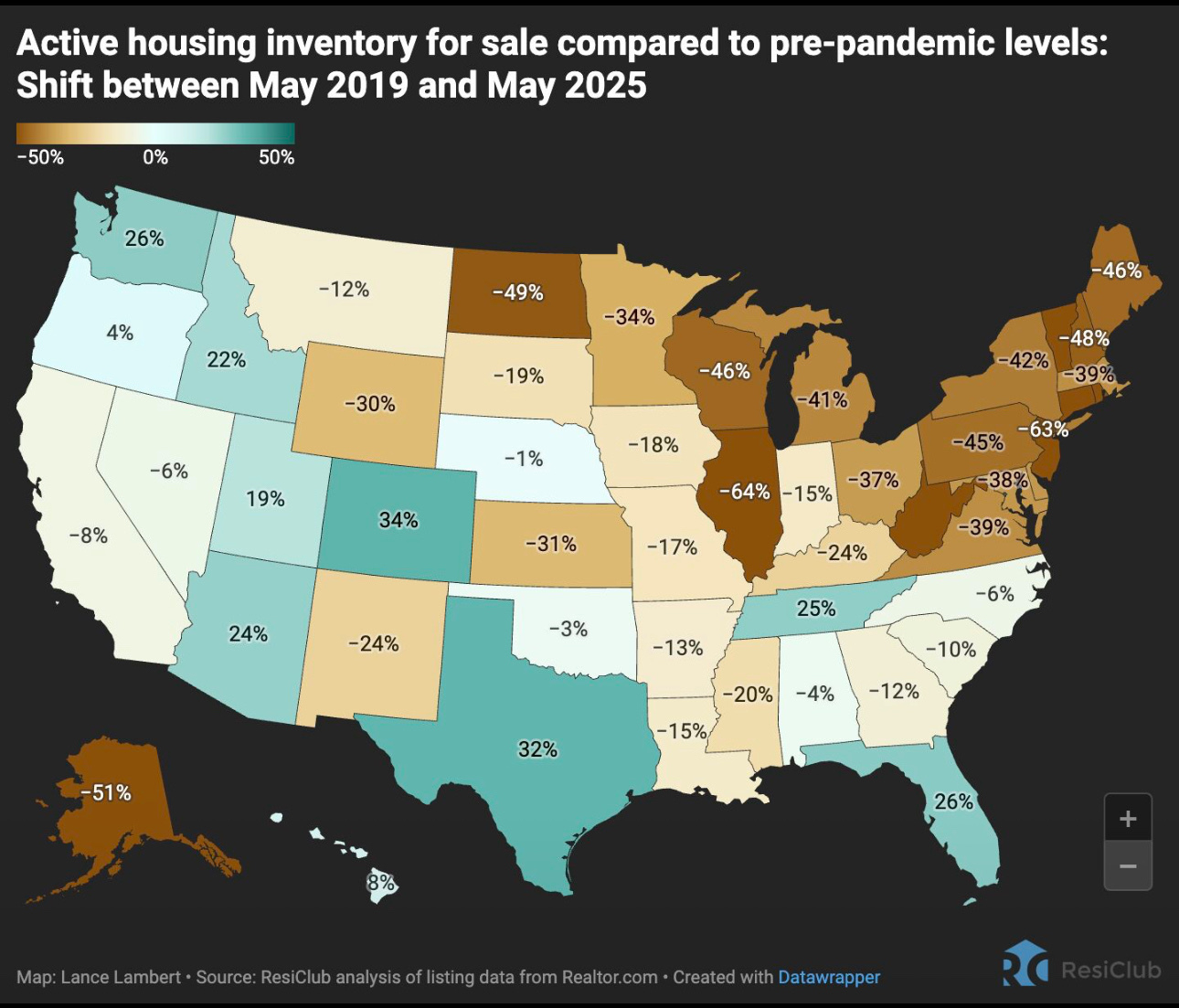

“There is no housing shortage in the Midwest.” 🙄😑

Currently reading: The Gentle Art of Swedish Death Cleaning by Margareta Magnusson 📚

RSS > Newsletters.

Trying out the latest Reeder app from the maker of Mela, my go-to for saving and organizing recipes.

Perched on my hill.

I spoke briefly with the cyclist in the lower left of the frame once he got to the top of the hill. He said he was going to Chehalem Ridge Nature Park.

Are those headshots of the project team in a work proposal really the move?

If even half the total claim of 41 aircraft damaged/destroyed is confirmed, it will have a significant impact on the capacity of the Russian Long Range Aviation force to keep up its regular large-scale cruise missile salvos against Ukrainian cities and infrastructure.

Justin Bronk, a senior research fellow for air power and technology at the Royal United Services Institute

Ukraine’s Drone Attack Deep Inside Russia: What to Know - The New York Times

A kindergarten teacher at my son’s school unexpectedly passed away over the weekend. Being in kindergarten himself, he couldn’t begin to believe or process this. My heart hurts for the family, students and colleagues. Tough last full week of school.

Picked up a used 100-400mm XF for my X-T5 and took it out for a walk today.

One of these days she’ll catch those birds.

Finally, some good news.

TGIF.

I can’t believe this album is 10 years old. It came out just as I was moving to Oregon from Michigan, so it holds a special place in my heart.

Shake Shack and In-N-Out are now competing for territory.

Another Portland suburb is getting the Shake Shack treatment

Not a good time to be a permit tech in Portland.

Wilson, Kotek announce slate of policy changes to accelerate housing development in Portland - OPB

Had to get away from my desk for a bit this afternoon. Rural Washington County, Oregon.

I don’t know why I’m even surprised anymore.

U.S. Will ‘Aggressively’ Revoke Visas of Chinese Students, Rubio Says

Eleventh multi-day water fast on the books since mid April @ 52 hours. Easing back into eating tonight with some veggies and eggs after volunteering. Deeper into the weight loss and nearly into another BMI band (I know, I know). Empowering.

The consequence of having everything on demand is that I never can remember the name of that show I just watched.